Jerry, America’s AllCar app, found in its “2025 State of the American Driver Report” that rising car ownership costs are tightening household budgets and will likely shift planned spending this year.

The report is based on a national survey of 1,000 American drivers across all age groups and regions combined with internal research on insurance rates, inflation, and data-collection attitudes.

Jerry found that 55% of drivers shopped for car insurance in search of relief from soaring rates in the past 12 months, up from 38% a year ago.

Twenty-two percent said they switched insurers for lower rates and 27% chose a higher deductible in return for a lower rate. Twenty-six percent reduced their coverage.

The cost of car insurance resulted in cutting spending elsewhere including:

-

- Restaurant meals (40%)

- Entertainment (38%)

- Family vacations (32%)

- Clothing (30%)

- Groceries (about 26%)

Forty-nine percent of respondents making more than $129,000 a year shopped around for better deals in the last year while 53% settled for less coverage than they thought they might need.

Of those planning to buy or lease a new or used car this year, 22% said they previously would have but now they would consider a lightly used one due to higher prices for new vehicles.

Seventy-one percent said they consider the cost of car insurance when choosing a vehicle, including 85% of Gen Z and 75% of Gen X.

“Car insurance is more than just another expense — it’s become a financial stressor reshaping how people approach broader buying decisions,” said Art Agrawal, Jerry CEO and co-founder, in a press release. “Drivers are reducing coverage, raising deductibles, and switching insurers to combat these elevated costs. Many are even forgoing vacations, new clothes, and groceries to better manage budgets. It’s a reality that our team is committed to changing for good with our mission to make car ownership affordable and accessible.”

Top 10 bills ranked according to respondents’ level of confusion, uncertainty, and distrust:

-

- Car repair and maintenance

- Medical bills

- Car insurance

- Home repair services

- Home/renters insurance

- Utilities

- Professional services, such as a lawyer

- Credit cards

- Mortgage/rent

- Travel-related expenses

For some, high costs meant going uninsured. Nearly 1 in 10, or 9.7%, said they went uninsured for “at least a while” in the previous year because of expensive premiums.

Josh Damico, Jerry’s vice president of insurance operations, shared his predictions on what’s in store for drivers this year.

“2025 is poised to be a year of stabilization for car insurance rates,” he said, in the release. “While small rate increases of 2-3% are expected as the market returns to normal, this is a welcome shift after the 50% rise in rates over the last three years. It is a sign of the market regaining balance and the ideal time for American drivers to explore new car insurance options.”

Jerry contends based on its findings that vehicle ownership costs will likely never return to pre-COVID levels despite inflation seemingly beginning to come under control with used car prices nearly 30% higher and new cars up about 20%.

“The bottom line: Owning a car is far more expensive than it was a few years ago and there is little reason to believe that will ever change,” the report states. “Repair costs are up 41% over the past two years and maintenance costs are up 28%, adding to the overall financial stress of car ownership. In fact, worries about the impact of an unexpected repair job weigh on a huge portion of American drivers. More than 40% say they ‘often’ or ‘always’ worry that they’ll need a repair that will cause serious financial hardship for them and their family. That’s up from 33% who said so in a similar survey in May 2023 and includes 1 in 5 respondents with a household income above $129,000.

“Yet that’s not surprising, given that a third of drivers (33%) said if they faced a $1,000 repair job tomorrow, they wouldn’t have enough money in the bank to pay for it immediately. That includes 51% of Gen Z, the highest of any generation, and 37% of women (versus 29% of men). That also includes a quarter (24%) of drivers with a household income of $78,000-$129,000 and 11% of those with a household income above $129,000.”

Regarding artificial intelligence features, 6.6% said they trust collision avoidance and blind spot monitoring, for example, to perform effectively in high-risk situations. Thirty-five percent said they moderately trust AI-driven safety features. One in four said they didn’t trust the features.

Thirty-nine percent said they’re annoyed by AI-driven features that have been around for years, such as blind spot monitoring.

“Drivers don’t have a lot of trust in even the most basic AI-driven safety features — a warning to automakers working on fully autonomous driving,” the report states. “Younger generations trust the AI-driven safety technology more than their older counterparts with slight majorities of Gen Z (51%) and Millennials (53%) expressing high or moderate trust versus just 41% of Gen X and 26% of Boomers.”

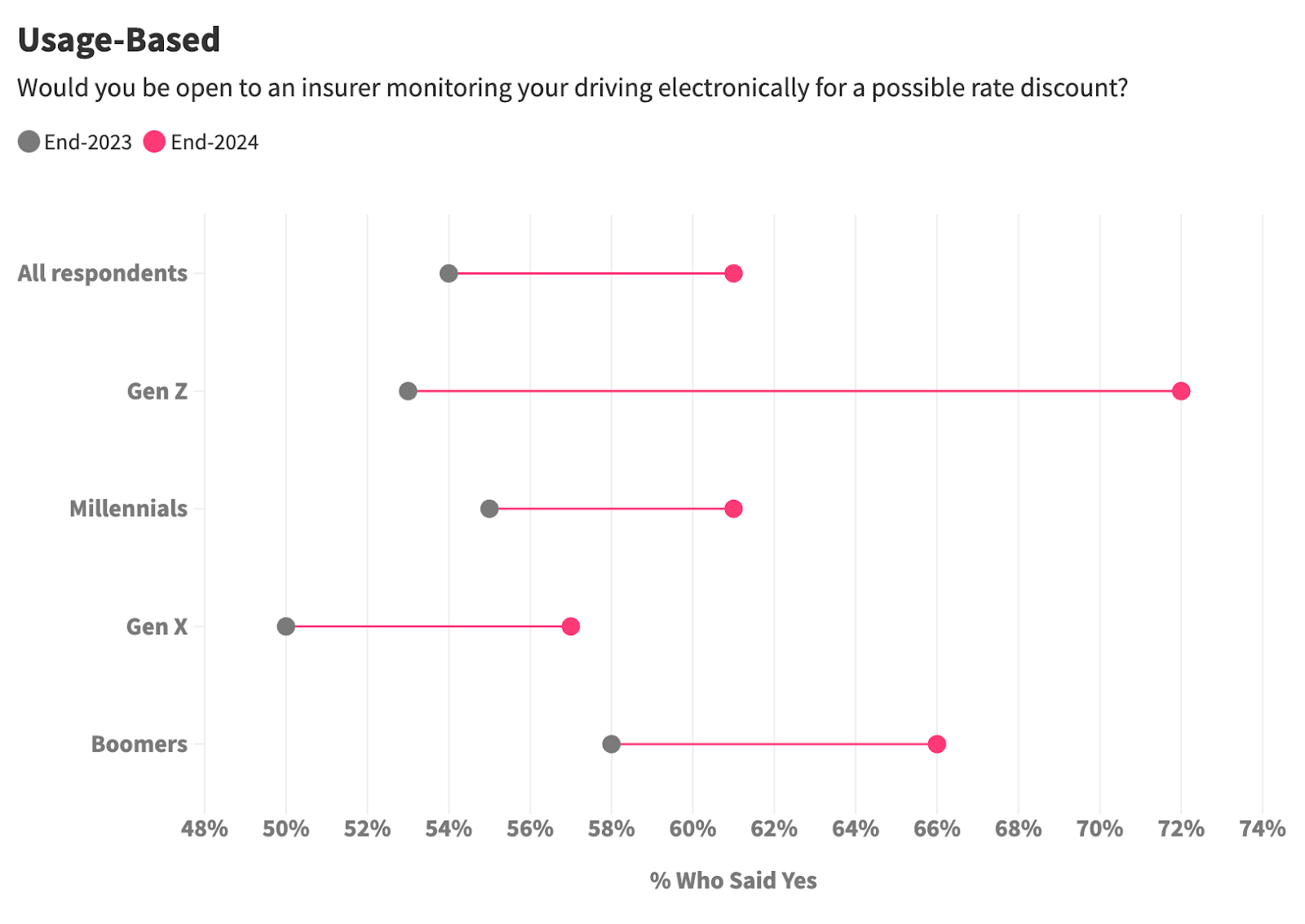

As insurance rates rise rapidly, more people are at least open to remote electronic monitoring of their driving if it means a possible rate discount, according to the report.

“A solid majority (61%) said they would consider that trade-off, up from 54% just a year ago. Attitudes about this appear correlated with age (which is, perhaps, also linked to financial need and openness to technology and data-sharing). Nearly three-quarters (72%) of Gen Z respondents said they would be open to electronic monitoring, compared with 61% of Millennials, 57% of Gen X, and 56% of Boomers.

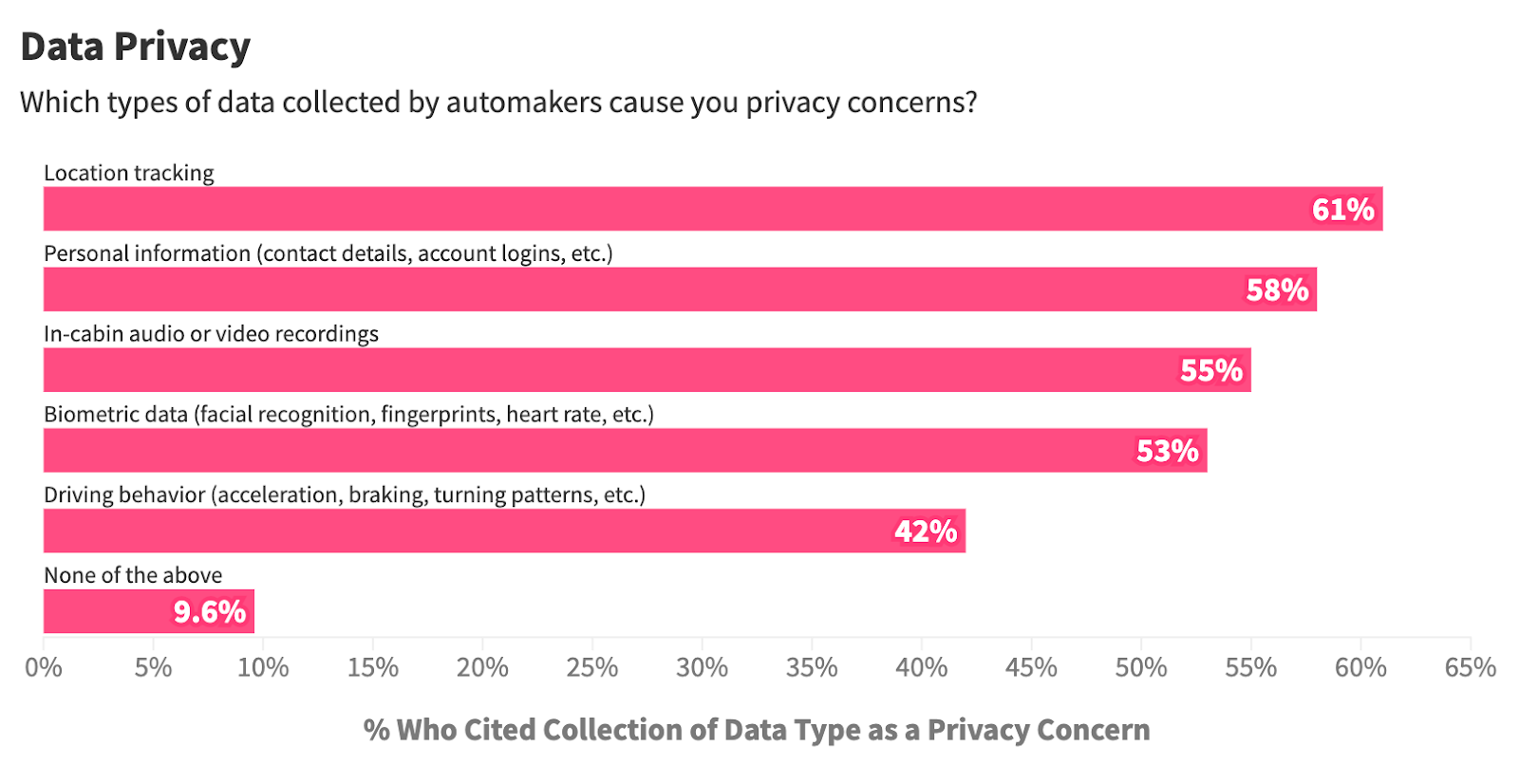

“On the other hand, a majority of drivers (54%) said they would consider leaving any insurer that required electronic monitoring of their driving. More than a third (35%) said they would be uncomfortable and another 41% would be extremely uncomfortable if insurers obtained such data for rate-setting purposes from data brokers or their car’s manufacturer.”

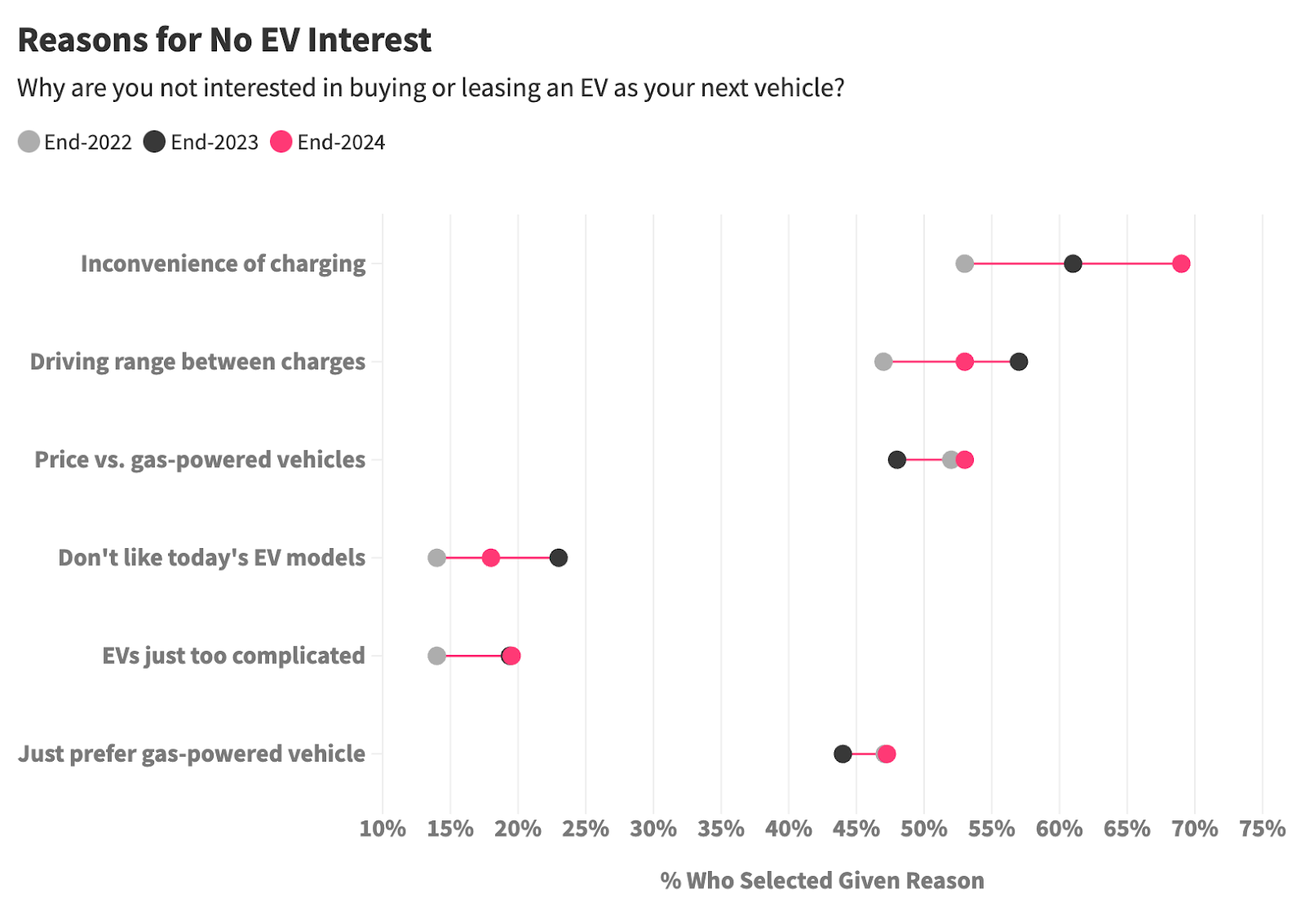

The survey also asked about interest in purchasing an EV. For the second consecutive year, 83% said that if given a choice of two identical vehicles at the same price — a hybrid that does not require charging and an EV that does — they would choose the hybrid, according to the report.

Nine percent of drivers said it will be at least 10 years before they get an EV and 37% say they don’t plan to ever have an EV. Jerry found that both figures were up slightly compared to a year ago. Those in the “never” category include 26% of Gen Z and Millennial respondents.

‘The number of public EV charging stations has more than doubled since 2020, and 64% of Americans now live within 2 miles of one,” the report states. “But the inconvenience of charging remains the top reason people cite for their lack of interest in buying an EV and the number citing it continues to grow.”

Images

Logo and graphs provided by Jerry/”2o25 State of the American Driver Report”

Share This:

Related

Alice J. Roden started working for Trending Insurance News at the end of 2021. Alice grew up in Salt Lake City, UT. A writer with a vast insurance industry background Alice has help with several of the biggest insurance companies. Before joining Trending Insurance News, Alice briefly worked as a freelance journalist for several radio stations. She covers home, renters and other property insurance stories.