Should you tick the box for rental car insurance at the Avis, Budget or other rental car counter? Or does your personal auto insurance or credit card already offer this benefit? Given that supplemental insurance for rental cars can cost around $15 to $30 per day or more, it’s worth asking these questions first.

Figuring out card benefits before you travel is smart. But it can be arduous and confusing to wade through the perks offered by multiple rewards credit cards. A recent study from WalletHub did the heavy lifting for you, comparing the travel benefits of 94 credit cards from the ten largest issuers.

But before you compare travel credit cards for rental insurance perks, consider that you might not even need this insurance.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Do you need rental car insurance?

If you live in the U.S. and own a car for personal use, you likely don’t need additional insurance when you rent a car in the U.S. That’s because your own auto insurance policy will cover your rental car. But some U.S. states, like Florida and New Hampshire, only require more limited coverage for auto insurance. if your personal auto policy lacks collision and comprehensive insurance, your rental car could be underinsured in an accident or mishap.

Some of the better travel credit cards for travel also have rental car coverage in many international locations. But there are exceptions.

Either way, you should call both your credit card and your auto insurer before you rent a car, as your policy may have changed. And make sure you understand the different types of auto insurance.

Here is a summary of what personal auto insurance and the highest-rated travel credit cards may cover when you rent a car:

| Rental Car Insurance Scenarios | Personal Auto Insurance | The Best Travel Credit Cards |

| Travel in the U.S. | Yes | Yes |

| International Travel | No (except Canada) | Yes (though most cards exclude Italy, Ireland, Northern Ireland, Australia, Israel, Jamaica and New Zealand) |

| Business Travel* | No | Yes, with some exceptions |

| Luxury car rental | You may need additional insurance | Yes |

| Exotic cars, off-road, trucks | No | No |

*Government employees, such as military and postal workers, may have auto insurance coverage as an employment benefit. If you work for a private employer, check if you are covered under a company policy.

So, even if you have a personal auto insurance policy, it makes sense to get one of the best travel cards to cover a rental car in the following instances:

- The car or cars you have insured are worth much less than the car you intend to rent. Since most rental cars are fairly new, this is a common scenario.

- You plan to rent a car outside of the U.S. or Canada.

- You are planning to rent a car in the U.S. or abroad while traveling for business.

- Your personal auto insurance policy offers much less protection than a good travel credit card.

Comparing credit card issuers

Many financial institutions, like Bank of America or U.S. Bank, offer auto rental benefits. And perks will vary from card-to-card, so it’s important to understand the terms of each card.

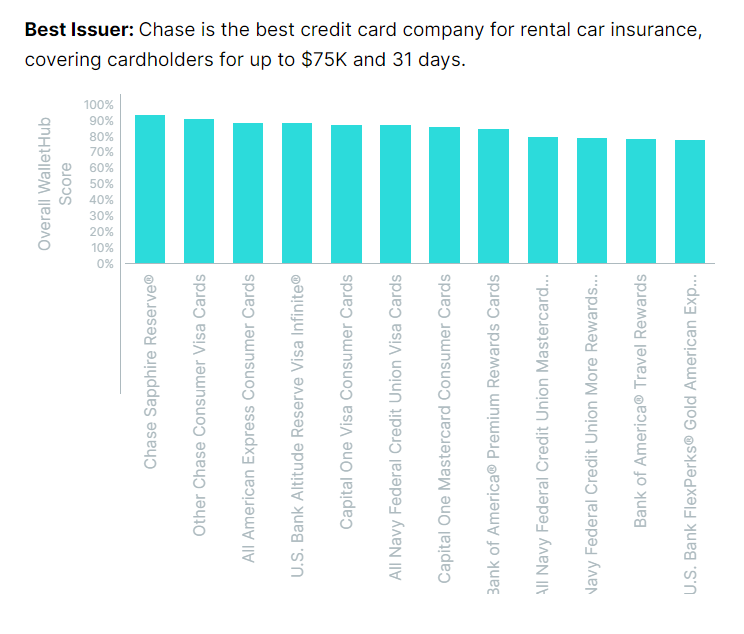

WalletHub found that of the personal credit card issuers in the chart below, Chase Bank offered the best rental car insurance benefits.

(Image credit: WalletHub)

No coverage: Citi, Synchrony and Discover do not offer any car rental coverage on any of their credit cards.

Best coverage from Chase and American Express

Chase credit cards offer the best car rental insurance when compared to other issuers. Chase will insure rentals globally, including in countries like Italy and Ireland that other cards may prohibit. Chase also boasts the highest per-vehicle coverage amount (up to $75,000), and coverage extends up to 31 days, whereas most competitors will insure only up to 15 days in your home country.

Finally, Chase cards cover damage that occurs when driving on a dirt or gravel road, and damage to tires and rims.

The top-scoring personal credit card according to WalletHub is Chase Sapphire Reserve®.

All other Chase consumer cards scored second for car rental benefits. For example, the Chase Sapphire Preferred® Card has a lower annual fee than the Sapphire Reserve card, but still offers solid travel benefits. For a review of the card, read our detailed article.

Third place goes to all American Express personal credit cards. In addition to excellent coverage, American Express offers Premium Car Rental Protection for a small fee per rental period, not per day. This benefit also extends to SUVs and luxury cars, unlike many other plans. For a review of the Green, Gold and Platinum American Express cards, read American Express Credit Cards: the Best Pick for You.

- Interest rate: 22.24% to 29.24% variable

- Annual fee: $550; $75 for each authorized user

- Foreign transaction fee: None

- Rewards: Get 10 points per dollar on spending at participating restaurants through the Chase Dining program as well as on hotel and car rentals booked through Chase Ultimate Rewards; five points per dollar on flights booked through Chase; three points per dollar on other restaurant and travel spending and one point per dollar on the rest of your purchases

- Other benefits: An annual statement credit of up to $300 for travel purchases (purchases that qualify for the credit do not earn points until the $300 travel credit has been applied), a Priority Pass Select membership for airport lounge access, perks at properties in the Luxury Hotel & Resort Collection, 10 points per dollar on Lyft rides through March 2025, at least a year of free membership to DoorDash’s delivery subscription service, and a $10 monthly statement credit toward purchases from home delivery service Gopuff

- Redemption: Points are transferable to partner airline and hotel loyalty programs, or trade points at a healthy rate of 1.5 cents each when you redeem them for travel bookings through Ultimate Rewards, or for statement credits against purchases in rotating categories through Chase’s Pay Yourself Back program (including Airbnb, dining, charitable donations, and other categories)

- Sign-up bonus: 60,000 points if you spend $4,000 in the first three months, for a total value of $900 toward travel when you redeem through Chase ultimate rewards

- Member FDIC

- Interest rate: 21.24% to 28.24% variable APR for purchases and balance transfers, and 29.99% variable APR on cash advances

- Annual fee: $95

- Foreign transaction fee: None

- Rewards: Five points per dollar on travel purchased through Chase Ultimate Rewards® and two points per dollar on other travel spending; three points per dollar on dining, and select online grocery and streaming services; and one point per dollar on other spending

- Other benefits: Get $50 in statement credits annually for hotel stays booked through Chase; on each yearly anniversary of opening your account, you get a 10% points bonus on total purchases made the previous year; the card offers some of the best car rental insurance benefits in the industry

- Redemption: Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel

- Bonus offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Ultimate Rewards®.

- Member FDIC

- Intro bonus: Earn 60,000 Membership Rewards® Points after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. Plus, earn 20% back on eligible travel and transit purchases made during your first 6 months of Card Membership, up to $200 back in the form of a statement credit.

- Interest rate: 20.99% to 28.99% variable APR

- Annual fee: $150

- Foreign transaction fee: None

- Rewards: Earn three Membership Rewards® points for every dollar spent on travel and transit (airfare, hotels, cruises, tours, car rental, campgrounds, vacation rentals, trains, taxis, rideshares, ferries, tolls, parking, buses and subways). Also earn three points for every dollar spent on eligible dining, including takeout and delivery in the U.S.

- Airport Security Clearance: Receive up to $189 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express® Green Card.

- Other Travel Benefits: Trip delay insurance up to $300 for certain expenses on a round-trip ticket paid for exclusive with your card – see terms for limitations; plus get a $100 annual statement credit toward LoungeBuddy, and app that helps you gain access to travel lounges

- Redemption: There is no option for cash back; the greatest value comes from booking travel with points, and from the many discounts and other perks

- Terms apply

How to use your card for rental car insurance

Using your card’s travel benefits, rather than the rental company’s insurance, is simple. Once you have obtained or decided to use a card with solid rental car insurance, use that card to reserve a rental car. Then decline the theft and damage insurance offered by the rental company, and be sure to pay for the car rental with the same credit card.

Based in New York, Stephen Freeman is a Senior Editor at Trending Insurance News. Previously he has worked for Forbes and The Huffington Post. Steven is a graduate of Risk Management at the University of New York.