The outdoor recreation industry generates $16 billion in spending and employs 192,000 people full and part-time, according to state statistics. Activities like skiing, rafting, climbing, and hiking are not only a major economic engine – especially in Deschutes County – they are also a key element of many people’s identity as Oregonians.

Advocates are warning that a decade-old legal case is threatening the viability of that industry, and people’s ability to access the activities they love. And, they argue, there are knock-on effects that impact fitness clubs and gyms as well. The City Club of Central Oregon took on this topic on Thursday, January 8, in a forum held at Central Oregon Community College titled, “Slippery Slopes: Why Oregon’s Recreation Industry Is On Thin Ice.”

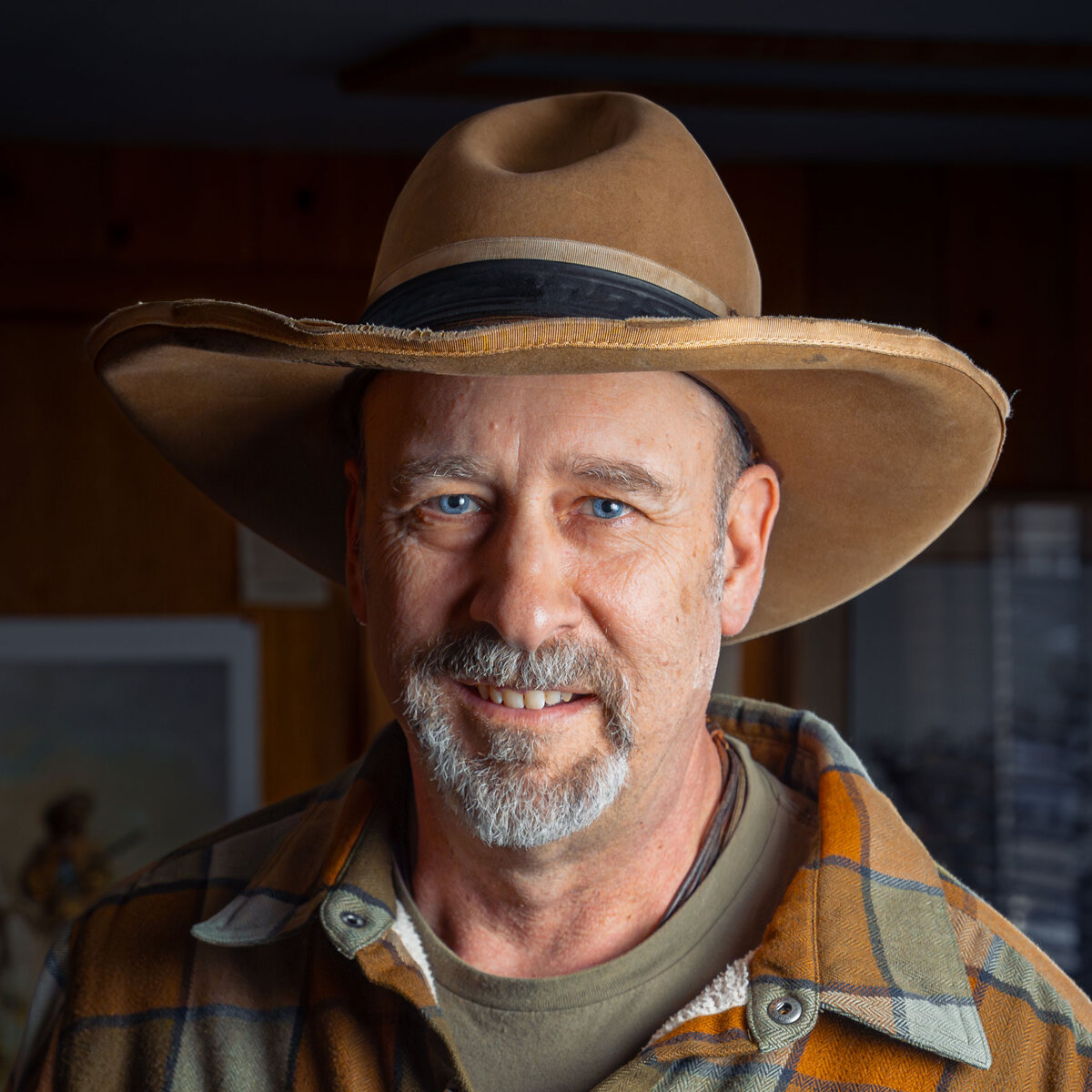

Photo by Jim Cornelius

Sisters Athletic Club owner Tate Metcalf explained to a City Club of Central Oregon forum how rendering liability waivers unenforceable in Oregon has impacted his ability to secure insurance for his business.

The concern stems from the 2014 Bagley vs. Mt. Bachelor ruling by the Oregon Supreme Court. Myles Bagley was an 18-year-old snowboarder when he was paralyzed after a terrain park jump went wrong. Bailey had signed a liability release, but the court found that the waiver was “unconscionable” – that it was unclear, and the “take-it-or-leave-it” nature of the contract represented an unfair disparity of bargaining power between a corporation and an individual. The actual case was settled, but the Supreme Court decision itself has left liability waivers as an essentially unenforceable dead letter in the state.

That, say industry advocates, has created a crisis.

“It is a full-on insurance crisis,” said David Byrd, director of Risk and Regulatory Affairs, National Ski Areas Association.

Byrd asserts that insurance companies are leaving the state of Oregon – similar to the crisis in homeowners’ insurance due to wildfire. In fact, Byrd noted, ski resorts are also facing problems due to wildfire-related property insurance struggles.

“We’re being hit from both sides,” he said.

Jordan Elliott, president, Pacific Northwest Ski Areas Association, said that insurance rates have increased seven-fold at Mt. Bachelor in the past five years, which has pushed recreation costs up for consumers – and there is concern that resorts and outfitters will simply not be able to obtain insurance – or financing – at all.

“The banks are looking at this stuff,” Elliott said.

Elliott several times emphasized that he and other recreation advocates take to heart the devastating impact Myles Bagley suffered in being rendered paraplegic in his accident.

“This is our community, and it breaks my heart that this happened to him,” Elliott said.

Lauren Bagley, the mother of Myles Bagley, sent a letter to the City Club – which was read in full at the start of the forum – expressing disappointment at what she perceives as the forum adopting and pandering to the framing of the issue as presented by the recreation industry. Bagley argues that waivers attempt to inhibit or circumvent a constitutional right to seek redress in court for wrongdoing or negligence on the part of operators. Myles Bagley has testified previously on the matter before the Oregon legislature.

Last year he told legislators, “Without liability, ski resorts have no financial incentive to ensure that their man-made terrain park features and other runs are safe. There are some factors in ski injuries that are beyond the control of ski operators, but they shouldn’t be able to shirk liability for man-made equipment or enhancements to the slope or keeping runs open when they are too dangerous and should be closed.”

The question of the enforceability of liability waivers goes well beyond the slopes. River outfitters and backcountry guides also face premium increases or difficulty obtaining insurance. Popular athletic events could also be affected.

Tate Metcalf, who serves as secretary for the Oregon Health & Fitness Alliance, said that the liability waiver enforceability issue has impacted health clubs and gyms, including his own Sisters Athletic Club (SAC), which he has operated for the past 24 years.

He said that insurance costs have increased by three- or four-fold across the industry – and many clubs and gyms are having a hard time finding and retaining insurance.

“The last year, my insurance company … dropped me, even though I’ve never had a claim,” he told the forum audience.

Metcalf said he had to approach 20 providers before he found one that would cover the club.

He notes that rock walls and swimming pools put clubs and gyms into a higher risk category. SAC does not have a rock wall, but it does have a pool, which Metcalf has always considered a critical part of the operation, providing aquatic exercise, and a resource for aquatic therapy.

SAC is up for sale. Metcalf was asked if the liability waiver and insurance issue has been a factor in his ability to sell the business.

“Yeah, it has come up,'” he said. “I can’t say it has stopped a sale, but it definitely has come up.”

Metcalf emphasized that his industry relies on waivers to protect themselves, not in order to evade their responsibilities.

“We got into this industry because we’re about people,” he said. “We want to make them healthier, not put them at risk.”

The Oregon legislature has attempted to take on the issue, but a bill to address it failed to get out of committee last year, despite having bipartisan support. Bipartisan legislation is expected to come up again in 2026.

Rep. Emerson Levy participated in the City Club forum, and committed to working on the issue.

“I have my constituents saying, ‘I can’t afford insurance’ – and we know that to be true,” she said.

Levy, whose 53rd District includes Sisters, said that legislation must ensure that waivers are clear, visible, and understandable. Any legislation, she said, would cover only “ordinary negligence” not “gross” or willful negligence, and would only apply to adults. District 54 Representative Jason Kropf, who also participated in the forum, said that legislation needs to define inherent risk, and establish what are the standards of responsibility for ski areas. He cited Colorado, where ski resorts established standards of practice and responsibility for themselves, as an example of a framework he would support.

“I think that’s a model we could adopt in Oregon,” he said.

Byrd emphasized that legislation must provide for summary judgement if the elements of a waiver are clearly met, so that the insured do not have to absorb extensive court costs to demonstrate that they met whatever an established standard demands.

Without action soon, advocates argue, it will become increasingly difficult for recreation industry entities to operate in Oregon, and access to the kind of activities that Oregonians build their identity around will become less accessible to the public due to cost or lack of availability. And, given the scope of the industry, that would have a serious economic impact.

“Oregon has a terrible business climate,” Byrd said. “This is one of the things we need to address on that.”

Clinton Mora is a reporter for Trending Insurance News. He has previously worked for the Forbes. As a contributor to Trending Insurance News, Clinton covers emerging a wide range of property and casualty insurance related stories.